Gatherful® Investing

Our investment strategies are crafted to match your financial plan. We don’t bucket you into canned portfolios like “moderate conservative” or “aggressive growth” based on a five-question survey. Instead, we customize your portfolio to your income and growth needs.

Your Plan as the Blueprint

Your life stage plan provides a blueprint for designing your investment portfolio. It tells us when you’ll need money and for what. It also indicates the types of resources that are available to fund your goals.

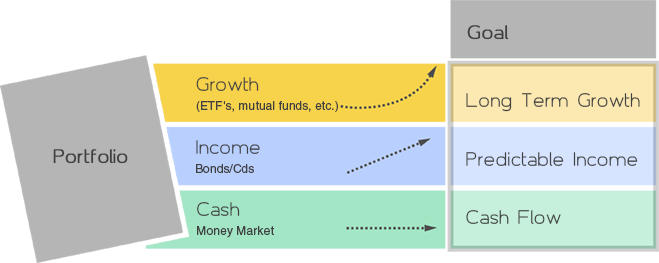

We match the investments in your portfolio to the jobs they need to do in your particular situation:

Cash: flexibility for handling emergencies and seizing opportunities

Bonds: stability and predictable income

Stocks: long-term growth and inflation protection

The ideal mix of cash, bonds and stocks is one that’s tailored to your plan’s requirements. We also consider taxes, investing costs and your comfort with risk when designing your portfolio.

Benchmarked to Your Goals

Your plan also provides a benchmark for performance. Using the Critical Path® system, you can see how your portfolio stacks up against the goals in your financial plan. Achieving your goals is a much more satisfying way of measuring the return on your investments than just a percentage number!

Stable Income during Turmoil

The income portion of your portfolio is designed to provide stability during periods of turmoil in the stock market or your life — or both. Bonds are the best when it comes to providing secure and predictable cash flow. We carefully craft your portfolio using low-cost index bond funds and investment-grade individual bonds to “bridge” over turbulent markets.

Cash flow matching: We engineer your portfolio to provide cash flow when you need it — like when you’ve planned a big purchase or need a regular “paycheck” during retirement.

Flexibility: By using individual bonds and bond funds, we have the flexibility to change your portfolio as your financial life plan evolves. This is in contrast to annuities and other income-producing products that have surrender charges and limits that restrict you.

Risk reduction for rising interest rates: As interest rates rise, the value of bonds gets eroded. We “immunize” individual bond portfolios by holding the initial bonds until maturity and buy higher yielding bonds for subsequent purchases. For portfolios holding bond mutual funds, we use short-term bonds to reduce the risk in rising interest rate markets.

Steady Growth for the Future

The growth portion of a solid portfolio is made up of stocks, the champs for long-term growth. We use low-cost index mutual funds blended together strategically:

Time targeting: We optimize your portfolio to maximize the chance of growth over a specific time horizon. The time horizon is synchronized with the number of years of predictable income provided by the income portion of your portfolio.

Global diversification with a tilt: We start with a globally diversified mix of stocks. Next, we add tilts to that mix that improve the probability of success and manage for downside risk and inflation.

Minimax Principle: We use a set of mathematical formulas based on the minimax principle. Our approach seeks to help your portfolio go down less when markets are bad so that you can recover sooner and get your plan back on track. That’s the “mini” part. At the same time, we look to benefit from up markets as much as possible, which is the “max” part.